- W-2s, W-3s, 1099-MISC, Information Returns Due Date: January 31

Get tips for being prepared to file Forms W-2, W-3 and some Forms 1099-MISC by the Jan. 31 due date. Learn about extensions. For more information, go to ... Watch Now

Watch Now

- 1099 & W-2 Forms Deadline (January 31, 2017)

http://www.expressirsforms.com/ Don\'t forget, January 31st, 2017 is an important deadline for tax filers! Business owners and other employers who normally file ... Watch Now

Watch Now

- 1099 Filing Penalty

Do you need to file a 1099? Watch Now

Watch Now

- Filing Deadline for W2s & 1099s

When your W2s and 1099s are due for filing, but your contractors are not responding, what do you do? Call XQ CPA! We know what to do! Watch Now

Watch Now

- Can you send 1099s late?

If you missed the 1/31 deadline for 1099s, fill them out any way to avoid larger penalties. Watch Now

Watch Now

- I-Team: What to Do When You Miss the Tax Filing Deadline

by Dana Fowle Aired April 18, 2018 ATLANTA - So you are going to miss the tax filing deadline? I know, sometimes life gets in the way. So now what? Well ... Watch Now

Watch Now

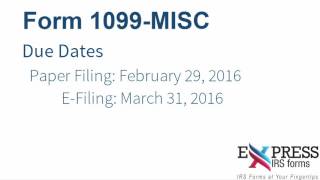

- DEADLINE and Filing 1099 Forms for the 2016 Tax Year

http://www.expressirsforms.com/ Welcome to ExpressIRSForms, one of the fastest, easiest, IRS-authorized e-filing programs for 1099s on the market. There are ... Watch Now

Watch Now

- How to fill out an IRS 1099-MISC Tax Form

Hiring a contractor can be a stressful job, but unfortunately your job is not done once you write that final check. At the end of the year you may also need to fill out ... Watch Now

Watch Now

- What to do if you miss the tax filing deadline

What to do if you miss the tax filing deadline. Watch Now

Watch Now

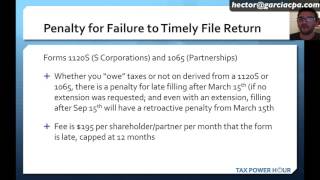

- TAX POWER HOUR: IRS penalties for late filing and late payment

IRS penalties for late fling and late payment by Hector Garcia, CPA 5:05 Tax filling and payment deadlines. and filing extensions 9:18 Penalty for Failure to ... Watch Now

Watch Now

- New IRS Penalties for 1099-MISC Starting Jan 2012

http://www.WageFiling.com Reporting form 1099-MISC late could be costly if not done within 30 days of the filing deadline this year. The IRS has increased the ... Watch Now

Watch Now

- IRS Company Penalties for Not Filing 1099s

Video by The Resourceful CEO provides details on what leads to penalties related to 1099s including penalties for not filing, late filing and filing incorrect 1099s. Watch Now

Watch Now

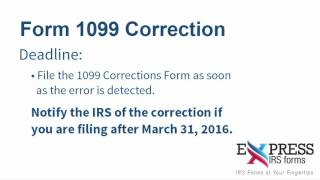

- E-file Form 1099 Correction with ExpressIRSForms

http://www.expressirsforms.com/ The 1099 correction form is used to report a correction on the Form 1099 you originally filed. There are two types of 1099 errors ... Watch Now

Watch Now

- What happens if you don't file your income tax return on time?

Featuring Attorney Charlie Price of the Price Law Firm in Orlando, Florida. Transcript: Attorney Tom Olsen: We\'re doing fantastic thank you. Charlie apparently a ... Watch Now

Watch Now

- Filing A 1099-MISC Online with eFileMyForms

How to print, mail and eFile with www.eFileMyForm.com. Watch Now

Watch Now

- 1099-Misc Reporting Questions & Answers

Is there a new deadline to file the payer copy of 1099-MISC? How do I determine if my business needs to issue a 1099 to a vendor? What else is reported on a ... Watch Now

Watch Now

- E-file Form 1099-R to Report Various Distributions

http://www.expressirsforms.com/ Prepare, E-File, & Report your IRS Information Returns with ExpressIRSForms Anyone who is committed to a trade or business, ... Watch Now

Watch Now

- Name That Deadline: 1099 & W-2 Filings

http://www.expressirsforms.com/ With ExpressIRSForms, count on fast and secure filing through a system built for your convenience. Thursday, March 31, 2016 ... Watch Now

Watch Now

- Form 8809 Extension 1099 & W2 Deadline

Form 8809 Extension 1099 & W2 Deadline. Watch Now

Watch Now

- E-file Form 1099-MISC for Miscellaneous Income

http://www.expressirsforms.com/ E-file Form 1099-MISC for Miscellaneous Income The IRS Form 1099 series is required when a taxpayer has income from ... Watch Now

Watch Now

Wednesday, June 12, 2019

1099 Filing Deadline

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment